Reducing Balance Method Formula

Cost of the asset recovery period. Even though on paper the total of the balance weights is correct the out-of-balance forces engine components are corrected by opposing forces balance weights as much as one foot away from them.

Reducing Balance Depreciation What Is Reducing Balance Depreciation

Double declining balance is calculated using this formula.

. Use the formula thats outlined above to calculate the depreciation and understand the cash flow on your balance sheet. Reducing balance depreciation is also known as declining balance depreciation or diminishing balance. Diminishing balance or Written down value or Reducing balance Method.

If the car behind them pits at the end of the lap will they lose a position to this car or more positively which cars have the possibility of making an undercut. After Analyzing heat losses in industrial boilers boiler engineers or technicians can help you to increase your boiler efficiency by 6 10. The new Undercut Threat graphic launching this weekend the latest in the F1 Insights series powered by AWS will provide fans and broadcasters an opportunity to understand which cars are at threat from an undercut ie.

RICE is a simple at-home treatment for sprains and strains. To get that first calculate. This product works best for all shades of hair.

Makes reducing gray easy. During the process of finding the relation between two variables the trend of outcomes are estimated quantitatively. More about our method.

The DuckworthLewisStern method DLS is a mathematical formulation designed to calculate the target score number of runs needed to win for the team batting second in a limited overs cricket match interrupted by weather or other circumstances. This method is used to find the integrals by reducing them into standard forms. Our expertise Put your.

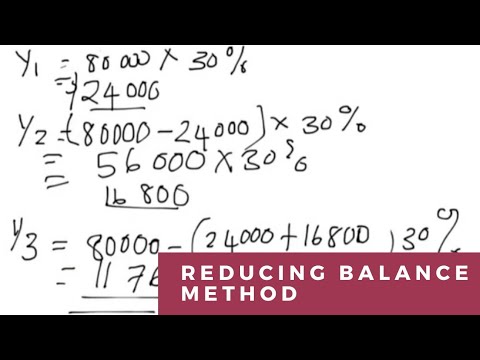

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. R 1 -. The reducing balance method of depreciation results in declining depreciation expenses with each accounting period.

The least square method is the process of finding the best-fitting curve or line of best fit for a set of data points by reducing the sum of the squares of the offsets residual part of the points from the curve. The double declining balance formula. Boiler Efficiency Improvement Steps.

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. Following formula should be applied under given conditions. All you have to do is wash your beard Also available in shampoo shampoo for light shades and anti-dandruff shampoo.

If one part breaks down the wheel stops spinning. This process is termed as regression analysis. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

The calculation of correct rate of depreciation is very important under this method. Using the percentage Declining balance depreciation method. Just use it instead of your beard wash until you like what you see.

At the end of the day the most important thing is that you do whats right for your business. With Hintsas coach our senior leaders worked on goals such as reducing stress achieving better balance improving sleep and recovery and. Here are the few boiler efficiencies boosting steps listed below.

In the 2nd year it could depreciate 20 on the remaining balance that is 1500 leaving the balance of 6500 and so on. Complete combustion of fuel so that no unburnt is left behind is a good practice and will add to the boiler efficiency. 7-time Formula 1 World.

In this way the amount of depreciation each year is less than the amount provided for in the previous year. 2 x basic depreciation rate x book value. Declining Balance Method.

In other words more depreciation is charged at the beginning of an assets lifetime and less is charged towards the end. The reducing balance method helps to reflect these details accurately. Declining or reducing method of depreciation results is diminishing balance of depreciation expense with each accounting period.

Under the reducing balance method the amount of depreciation is calculated by applying a fixed percentage on the book value of the asset each year. When the cost of asset residual value and useful life of an asset is given. This means that the crankshaft is subject to bending forces from both directions all the time even when the engine is in a favorable RPM range where the 50 factor is most.

Thus FIFO method provides a close approximation of the replacement cost on the balance sheet as the ending inventory is made up of the most recent purchases. Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. However the disadvantage of using FIFO method is that there is a mismatch between the.

Triple patented formula keeps beard hair looking stronger and healthier. For example if we have to find the integration of x sin x then we need to use this formula. Drastic positive change in net working capital means that cash balance is reducing very rapidly and if unprecedented circumstances arrived companies have to sell their fixed assets to pay off.

Double Declining Balance Depreciation Method. Under reducing balance method. For the wheel to turn smoothly all parts need to be in balance.

Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Learn how rest ice elevation and compression can help you reduce pain and recover more quickly. Integration By Parts formula is used for integrating the product of two functions.

The method was devised by two English statisticians Frank Duckworth and Tony Lewis not to be confused with former. Reducing Balance Method. In nutshell business managers should keep a close eye on the change of working capital and raise a flag if it is going out of control.

Straight Line Vs Reducing Balance Depreciation Youtube

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

No comments for "Reducing Balance Method Formula"

Post a Comment